How FP&A Can Contribute to Organizational Agility

In today’s fast-paced and often unpredictable business environment, organizations must remain agile to survive and thrive. Agility refers to the ability of an organization to respond quickly to changes, adapt to new opportunities, and pivot when necessary. This capacity for flexibility is essential in the face of changing market conditions, economic shifts, and internal transformations. Financial Planning and Analysis (FP&A) teams play a critical role in fostering organizational agility by providing data-driven insights, guiding strategic decisions, and ensuring financial flexibility.

In this article, we’ll explore how FP&A professionals can enable agility within an organization, helping businesses navigate uncertainty, adapt to change, and drive long-term success.

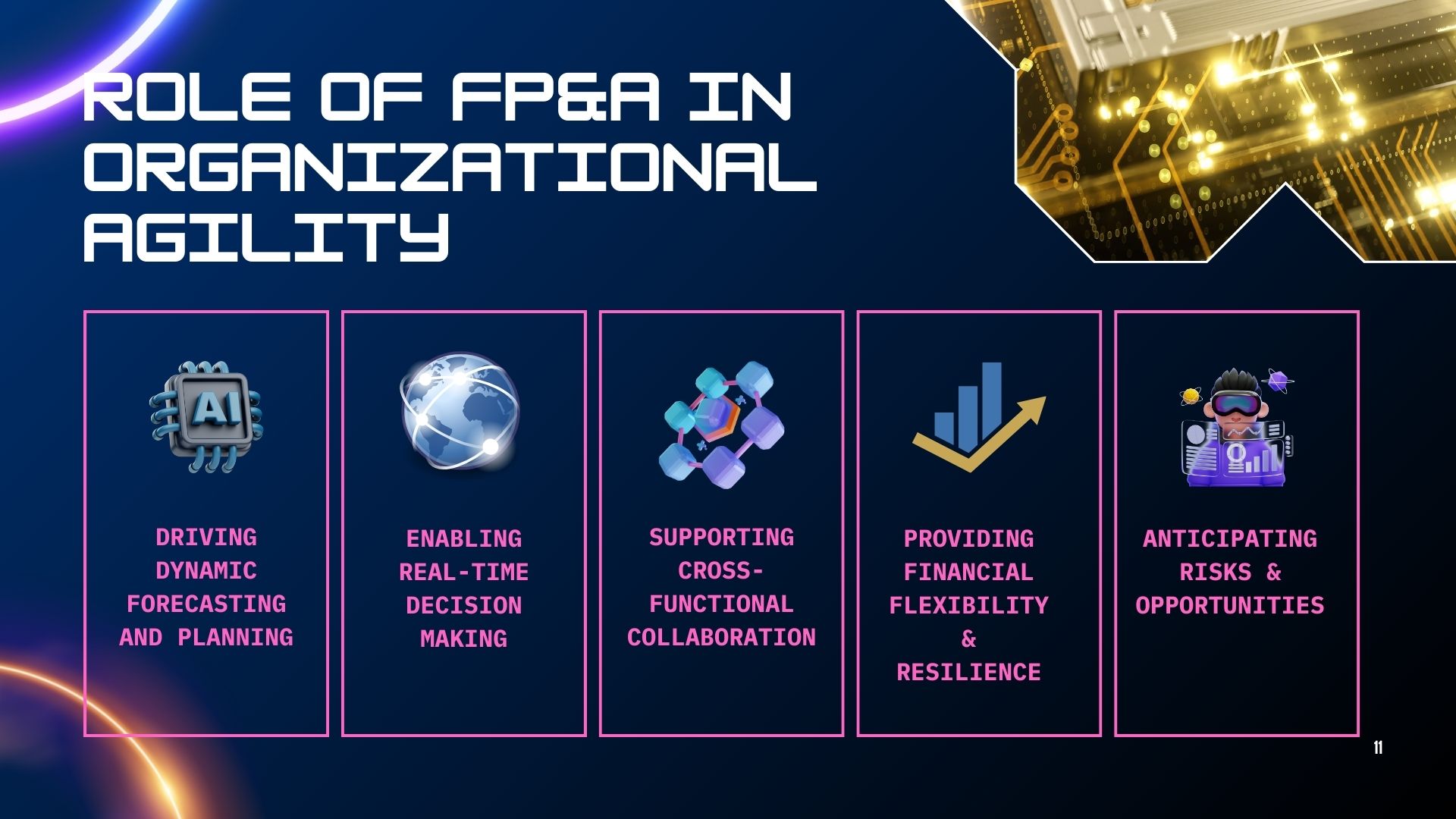

The Role of FP&A in Organizational Agility

Organizational agility is not just about being able to respond quickly to external changes—it also involves the ability to plan proactively, adjust resources efficiently, and make informed decisions at every level. FP&A professionals help ensure that the organization remains flexible by providing actionable financial insights, building adaptive forecasting models, and driving collaboration across departments.

Here’s how FP&A can contribute to agility:

- Driving Dynamic Forecasting and Planning

- Enabling Real-Time Decision Making

- Supporting Cross-Functional Collaboration

- Providing Financial Flexibility and Resilience

- Anticipating Risks and Opportunities

- Driving Dynamic Forecasting and Planning

Traditional financial forecasting often relies on annual or quarterly planning cycles, which can become outdated as market conditions evolve. In an agile environment, FP&A teams shift toward dynamic and rolling forecasts that are updated frequently—sometimes monthly or even weekly—to reflect the most current data and assumptions.

How FP&A Achieves Dynamic Forecasting:

- Scenario Planning: FP&A teams create multiple scenarios to anticipate different potential outcomes. By modeling various “what-if” scenarios, they help the organization prepare for both positive and negative shifts, ensuring that it is ready for any market conditions or internal changes.

- Rolling Forecasts: Instead of waiting for the next annual budget cycle, FP&A teams continuously update financial forecasts to reflect actual performance, new information, and shifting assumptions. This enables leadership to make informed decisions on a more frequent basis.

- Shorter Planning Cycles: By adopting shorter planning cycles, FP&A teams can adjust more quickly to changes. For example, if there’s a major shift in the market, FP&A teams can revise forecasts within weeks, providing the organization with the agility to react promptly.

- Enabling Real-Time Decision Making

Agility requires speed, and to make quick, informed decisions, businesses need access to real-time financial data. FP&A teams enable real-time decision-making by implementing integrated financial systems and dashboards that provide up-to-date insights into key performance indicators (KPIs).

How FP&A Supports Real-Time Decision Making:

- Data-Driven Dashboards: FP&A professionals create real-time dashboards that provide executives and business leaders with immediate visibility into financial metrics, such as cash flow, profitability, and key cost drivers. This empowers decision-makers to respond to changes quickly, based on the latest data.

- Predictive Analytics: FP&A teams use predictive analytics and financial modeling to forecast trends, allowing leaders to anticipate future market conditions and plan accordingly. This helps the organization pivot or take advantage of emerging opportunities in a timely manner.

- Integrated Financial Systems: By integrating financial systems with other business functions such as sales, operations, and marketing, FP&A teams can provide a more comprehensive view of the business. This integrated approach allows decision-makers to see the full picture in real time, enabling quicker and more accurate decisions.

- Supporting Cross-Functional Collaboration

Agility is not solely the responsibility of FP&A or any single department—it requires collaboration across the entire organization. FP&A teams can help foster a more agile company by acting as a bridge between finance and other business functions, ensuring that decisions are aligned and based on accurate financial data.

How FP&A Promotes Cross-Functional Collaboration:

- Collaborative Budgeting and Forecasting: FP&A teams work closely with departments such as sales, operations, marketing, and HR to create a more collaborative approach to budgeting and forecasting. By incorporating input from various departments, FP&A can develop more realistic financial models that reflect the needs and objectives of the business as a whole.

- Integrated Strategic Planning: Instead of working in silos, FP&A teams engage with various business units to align financial goals with strategic initiatives. By contributing to the development of organizational strategy, FP&A ensures that the financial plan supports the broader business vision, while also maintaining flexibility for changes.

- Cross-Departmental Communication: Regular communication between FP&A and other departments helps ensure that everyone is on the same page regarding financial goals, KPIs, and performance. This enables the organization to pivot quickly when necessary, as departments understand the financial implications of decisions and can respond accordingly.

- Providing Financial Flexibility and Resilience

Financial flexibility is crucial for organizational agility, especially when dealing with economic uncertainties, market disruptions, or unforeseen events such as a global pandemic. FP&A teams can help the organization remain financially resilient by ensuring that there is sufficient liquidity and access to capital, as well as by identifying areas where cost efficiencies can be realized.

How FP&A Enhances Financial Flexibility:

- Liquidity Management: FP&A teams track cash flow and liquidity levels to ensure that the company has sufficient resources to weather unexpected downturns. By forecasting potential cash flow challenges and managing working capital efficiently, FP&A teams help the organization remain financially agile during uncertain times.

- Capital Allocation: In an agile organization, capital allocation decisions need to be flexible and responsive to change. FP&A professionals help assess the ROI of various investments and guide leadership on how to allocate resources to the most critical projects that drive growth, innovation, or cost savings.

- Cost Optimization: FP&A teams continuously evaluate cost structures and look for opportunities to optimize spending. This may include identifying non-essential expenses that can be reduced or deferred, freeing up capital for strategic initiatives that align with the company’s goals.

- Anticipating Risks and Opportunities

Part of agility involves being able to anticipate and respond to both risks and opportunities. FP&A teams help organizations stay ahead of the curve by identifying potential risks—such as economic downturns, supply chain disruptions, or market shifts—and preparing for them in advance. Conversely, they also help spot emerging opportunities, such as new markets or untapped customer segments, and guide the organization on how to capitalize on them.

How FP&A Drives Proactive Risk Management:

- Risk Identification: FP&A teams use data analytics and scenario modeling to assess potential risks and their financial impact. By regularly monitoring internal and external variables, such as interest rates, currency fluctuations, and supply chain issues, FP&A can help the organization avoid or mitigate risks before they become critical.

- Opportunity Forecasting: Just as FP&A teams identify risks, they also spot opportunities that can drive growth. For example, by analyzing market trends and customer behavior, FP&A professionals can highlight areas where the organization can expand, invest, or innovate, giving the company the flexibility to pursue new ventures as they arise.

- Scenario-Based Planning: FP&A teams use scenario-based planning to evaluate a range of potential risks and opportunities, giving the organization the ability to adapt quickly. By preparing for multiple future outcomes, the business can act swiftly when conditions change.

Conclusion: FP&A as a Catalyst for Organizational Agility

In an environment where change is constant and often unpredictable, organizational agility is essential for success. FP&A professionals play a crucial role in fostering this agility by providing dynamic forecasting, enabling real-time decision-making, driving cross-functional collaboration, ensuring financial flexibility, and helping the organization anticipate risks and opportunities.

By aligning financial planning with strategic goals, FP&A ensures that the organization remains responsive and adaptable, capable of navigating through challenges and seizing new opportunities. Ultimately, FP&A is not just a financial function—it is a strategic enabler that helps organizations stay agile, resilient, and ready for whatever the future may hold.

As businesses continue to face new challenges and opportunities, the role of FP&A in supporting agility will become even more critical. With the right tools, processes, and mindset, FP&A professionals can empower their organizations to thrive in a rapidly changing world.